Contrasting Popular 2D Payment Gateways: Features and Rates Clarified

Contrasting Popular 2D Payment Gateways: Features and Rates Clarified

Blog Article

The Duty of a Payment Gateway in Streamlining E-Commerce Repayments and Enhancing User Experience

The assimilation of a settlement entrance is crucial in the ecommerce landscape, serving as a safe and secure avenue between customers and vendors. By making it possible for real-time deal handling and supporting a selection of payment techniques, these gateways not only mitigate cart abandonment yet likewise boost total client satisfaction.

Recognizing Payment Entrances

A payment entrance works as an important intermediary in the ecommerce purchase process, promoting the protected transfer of repayment information between merchants and clients. 2D Payment Gateway. It makes it possible for online companies to approve numerous forms of repayment, consisting of charge card, debit cards, and digital purses, therefore widening their customer base. The gateway operates by encrypting delicate information, such as card information, to make certain that data is transmitted securely over the web, minimizing the danger of fraudulence and information breaches

When a customer initiates a purchase, the payment portal captures and forwards the transaction data to the suitable banks for permission. This process is commonly smooth and takes place within secs, giving consumers with a liquid purchasing experience. In addition, payment gateways play a pivotal duty in conformity with sector requirements, such as PCI DSS (Settlement Card Market Information Protection Criterion), which mandates stringent safety steps for refining card settlements.

Understanding the technicians of repayment entrances is necessary for both sellers and customers, as it straight impacts deal performance and customer trust. By guaranteeing effective and secure purchases, payment entrances add substantially to the general success of e-commerce organizations in today's digital landscape.

Trick Attributes of Payment Gateways

Several vital functions specify the effectiveness of repayment gateways in shopping, guaranteeing both security and comfort for users. One of one of the most crucial attributes is robust security procedures, consisting of encryption and tokenization, which secure delicate client information during deals. This is crucial in promoting trust fund between vendors and customers.

In addition, real-time deal processing is vital for making certain that settlements are finished quickly, minimizing cart abandonment prices. Payment portals likewise offer fraud discovery tools, which monitor deals for suspicious task, further safeguarding both vendors and consumers.

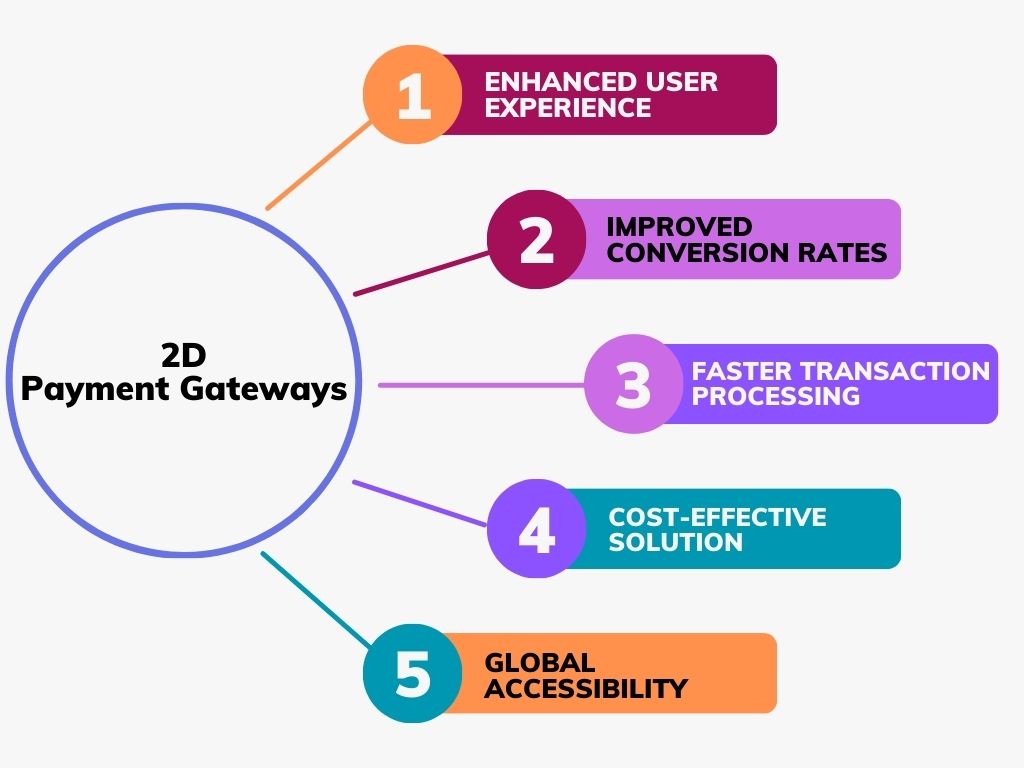

Advantages for E-Commerce Services

Various advantages occur from incorporating repayment entrances right into shopping organizations, dramatically improving functional effectiveness and customer satisfaction. Repayment portals facilitate seamless deals by safely refining settlements in real-time. This capability minimizes the likelihood of cart abandonment, as clients can swiftly complete their acquisitions without unneeded delays.

Additionally, settlement gateways sustain several repayment approaches, accommodating a diverse series of client choices. This versatility not only brings in a more comprehensive consumer base but likewise cultivates loyalty amongst existing customers, as they really feel valued when published here provided their favored repayment choices.

Furthermore, the combination of a payment portal usually causes enhanced safety and security features, such as security and scams discovery. These procedures safeguard delicate client information, therefore developing trust and credibility for the ecommerce brand.

Moreover, automating repayment processes with entrances reduces hands-on workload for staff, permitting them to concentrate on calculated initiatives instead of routine tasks. This operational efficiency converts into expense financial savings and enhanced source allotment.

Enhancing Customer Experience

Integrating a reliable payment entrance is important for enhancing individual experience in shopping. A reliable and smooth repayment process not just constructs consumer depend on yet also reduces cart desertion rates. By offering several repayment choices, such as charge card, digital budgets, and financial institution transfers, services deal with varied customer preferences, thus improving complete satisfaction.

Moreover, an easy to use user interface is crucial. Payment gateways that use intuitive navigation and clear instructions allow clients to total purchases promptly and easily. This ease of use is vital, especially for mobile consumers, who require optimized experiences customized to smaller screens.

Protection attributes play a substantial duty in individual experience. Advanced file encryption and scams detection mechanisms assure customers that their sensitive information is shielded, cultivating self-confidence in the deal process. In addition, clear interaction concerning fees and policies boosts trustworthiness and decreases potential frustrations.

Future Fads in Repayment Processing

As shopping remains to progress, so do the patterns and innovations shaping settlement handling (2D Payment Gateway). The future of settlement handling is marked by find more information numerous transformative fads that guarantee to improve performance and customer satisfaction. One substantial trend is the surge of fabricated knowledge (AI) and maker knowing, which are being significantly integrated right into repayment portals to boost protection with advanced scams discovery and danger analysis

Additionally, the fostering of cryptocurrencies is obtaining grip, with even more services discovering blockchain innovation as a sensible alternative to standard payment approaches. This shift not only supplies lower deal costs but likewise interest a growing market that worths decentralization and privacy.

Mobile wallets and contactless repayments are becoming mainstream, driven by the demand for quicker, easier transaction techniques. This fad is more fueled by the enhancing occurrence of NFC-enabled tools, enabling seamless deals with just a faucet.

Last but not least, the emphasis on governing conformity and information defense will shape settlement processing approaches, as businesses aim to develop depend on with customers while adhering to progressing lawful structures. These trends collectively suggest a future where repayment handling is not just much faster anonymous and more protected but additionally much more aligned with customer assumptions.

Conclusion

In conclusion, payment entrances act as essential parts in the ecommerce community, helping with effective and secure purchase processing. By offering varied payment alternatives and prioritizing customer experience, these gateways considerably minimize cart abandonment and enhance client contentment. The ongoing development of payment modern technologies and protection actions will certainly further strengthen their role, guaranteeing that shopping companies can meet the needs of significantly innovative consumers while promoting depend on and reputation in on the internet transactions.

By allowing real-time transaction handling and supporting a variety of settlement approaches, these gateways not only mitigate cart abandonment however also boost general customer fulfillment.A settlement portal offers as an important intermediary in the shopping deal procedure, helping with the safe transfer of repayment information between sellers and customers. Payment gateways play an essential function in conformity with sector requirements, such as PCI DSS (Repayment Card Sector Information Safety And Security Criterion), which mandates rigorous protection procedures for processing card payments.

A functional settlement entrance fits credit report and debit cards, digital pocketbooks, and different repayment techniques, catering to varied customer preferences - 2D Payment Gateway. Settlement entrances help with seamless deals by securely processing repayments in real-time

Report this page